Microsoft has mostly been recognized as the industry leader in technology and innovation. Having cornered 90% of world personal computer market and having massively popular enterprise services as a cash cow meant that Microsoft always carried significant advantage over its competitors and peers. It could literally burn few billions in cash and not break sweat over it. Or acquire couple of companies for few billions and choose to write the investment off as an unsuccessful bet. Microsoft had been the favorite of most of its critics at some point, and has been at loggerheads with various governments, domestically and overseas, and yet survived without breaking the bank. Employing more than 100,000 people since forever and leading the way in consumer and enterprise computing, Microsoft was easily considered too big to fail.

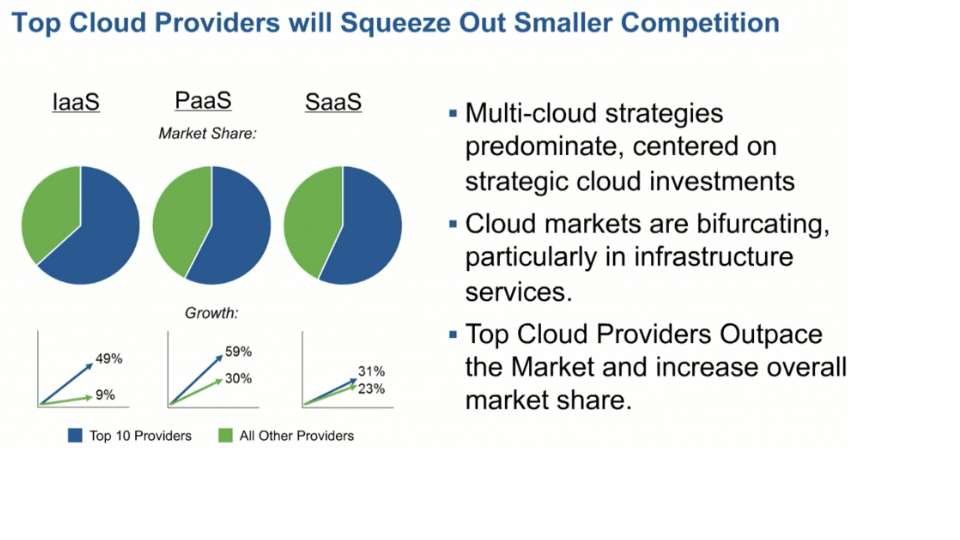

Yet during the late 2000s, trouble was brewing at Microsoft. The years leading up to 2014 were very difficult as Microsoft was seen struggling on various fronts. Part of the reason was internal while a big part of it lay outside Microsoft. Externally, technology itself was shifting along with user preferences and increasing complexity was no longer feared by most IT organizations. The focus was to move away from large, one vendor solution to having multi-vendor stack of products which gave the organization flexibility to choose the best providers. All these changes meant that Microsoft’s model was coming under increasing pressure.

Mobile platform was considered Microsoft’s biggest, most glaring shortcoming. At the start of 2014, Microsoft’s mobile market share amounted to just 3.5 percent. That was a dismal number, compared with Apple’s 15% and Android’s 80% market share. Additionally, its Surface tablet was struggling with less than 3% of the tablet market. This made Microsoft’s Windows the only major operating system that didn’t have a viable mobile component. The personal computer sales were declining at the same time, as shipments slowed down by more than 10% for the first time.

Apart from the above hardware troubles, Microsoft was coming under intense heat on the software and ecosystem side as well. Customers were growingly seeking a seamless, integrated user experience across devices and Microsoft was nowhere close to providing that. Bing remained a distant second to Google Search (18.7 percent versus 67.6 percent, respectively), and Microsoft had just released a free online version of Office — Microsoft Office Online — in response to Google Drive. Apps available on windows store numbered 1/5th of those available in App store and Google Play.

Further in the years leading to 2014, Microsoft was increasingly coming across as an organization happy to rest on its past laurels. Pace of innovation was slowing down, confidence in the organization was at an all time low, its products were seen as out of touch from market realities while the product pricing model was considered by many as greedy or obscene, or at best, overpriced. Microsoft was late to launch its smartphone, Windows phone, and the market was already in love with iPhones by the time first Windows phone came out – more than 3.5 years after the launch of first iPhone. Its new operating system, Windows 8, touted to provide seamless experience across devices was considered a market dud, while offerings such as Xbox gaming system lost out purely due to poor pricing strategy.

Dawn of an Era

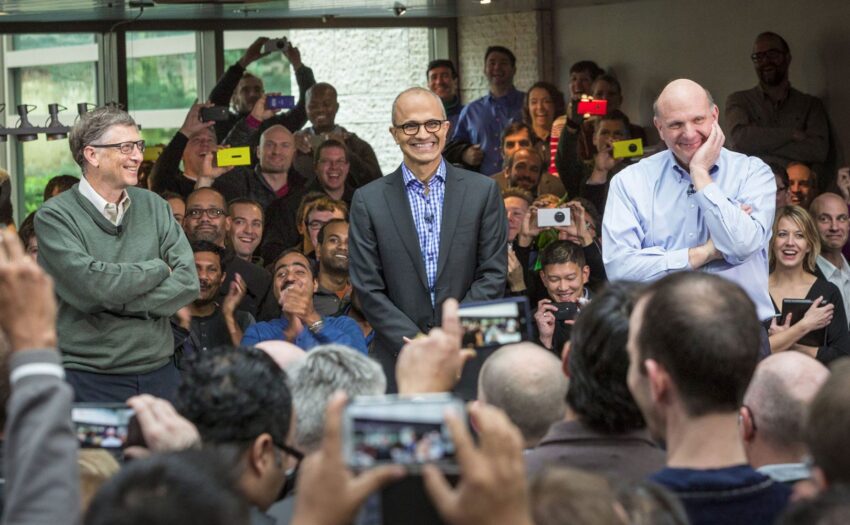

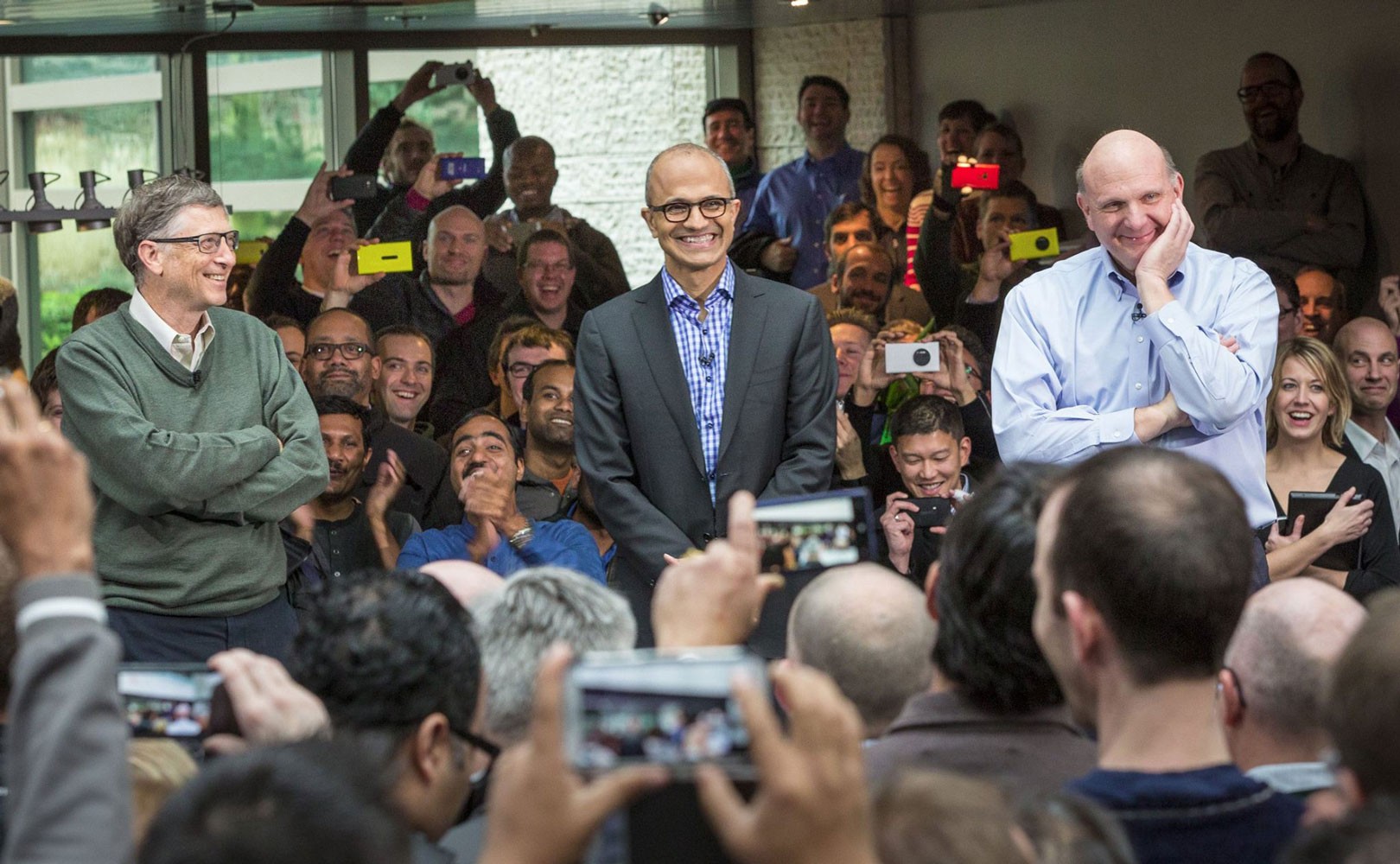

When Nadella took over as Microsoft’s CEO in Feb 2014, his challenges were immediate and spotlight was always on, as is expected in case of world’s 4th largest corporation.

When Nadella came on to take the charge at Microsoft, both analysts and Wall Street agreed that the organization was fading to irrelevance. Over the next 6 years, Nadella set out on an inspiring journey, one that would see Microsoft make radical changes, charting out its course amidst uncertainty. This journey would see Microsoft change its business structure, breaking new frontiers and boundaries, launch new products and repackage old products and forge new partnerships on the road to regain its lost charm. Nadella began this journey humbly and quietly, two attributes which have become his hallmark and an unmistakable part of his legacy. Looking back, his first decisions during his first year were the hardest any CEO can be expected to make anytime during their stint as CEO, yet the finesse and calmness displayed by Nadella is worthy of unparalleled praise.

In the almost 6 years since Nadella has taken over, Microsoft’s market cap has risen from $315 billion to $830 billion. Considering that Nadella came in when Microsoft was under pressure from all fronts, and then managing to turn around the ship completely is just incredible.

2014 and Beyond: Grand Strategy, the Nadella way!

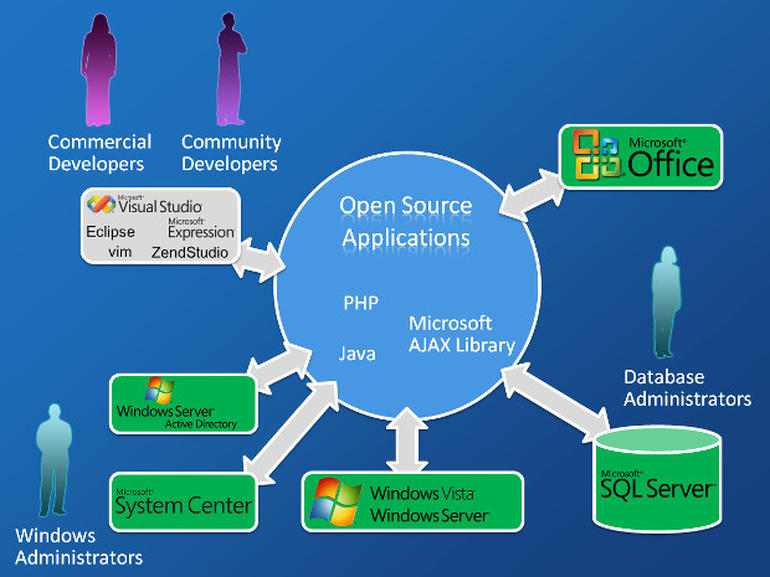

Image Source: zdnet

Nadella’s grand strategy for Microsoft covered 4 essential elements. First, to make any long lasting changes, he needed to fix the culture and maintain the improvements made in the short run. Second, products and services, across the domains of hardware and software need to reflect the changing customer outlook. Third, Microsoft needed to re-launch itself with unparalleled cooperation and collaboration, forging previously unthinkable partnerships. And fourth, in all its products and service offerings Microsoft needed to make a ruthless self-evaluation of Make vs Buy and proceed to acquire firms and businesses where it sees value.

Image Credit: Microsoft

Image Credit: Microsoft

Fixing Culture

Nadella immediately started working to create an outward focused, critique-hungry organization where formal power structures fade away to make way for productive partnerships; where direct communications are more important than showmanship; where tradition and hierarchy do not stand in way of pragmatism; and where ‘getting things done’ is more important than who does them. From his very first public appearance where he gave the impression of being directly approachable and responsible, to his first actions where he took decision to ramp down windows phone product line, Nadella meant change.

He fixed the culture through direct communication and leadership. He focused the company on cloud, winding down Windows Phone, de-emphasizing Windows as a whole, and turning Office and XBox into cloud-centric products. Back in the day, partners, vendors and developers alike talked about a much hostile environment, where it was difficult to get things done, or to get the needed resources, and the whole attitude was not geared towards cooperation. This attitude changed a great deal under Nadella and its clear that this change has a lot to do with ‘the buck stops here’ culture Nadella introduced. Not all of this worked perfectly every time, but by maintaining a growth mindset, they learned and improved. As a result, the company is the clear #2 cloud provider and occasionally the most valuable company in the US.

Windows run with everything, not just Windows run everywhere!

Nadella quickly made an impression and emphasized on Microsoft being a cloud-first and mobile-first company, moving away from a Windows-first company. The aim was to have Windows run with everything, not just having Windows run everywhere. Nadella knew that the latter goal was self-limiting and almost non-achievable whereas the former goal can lead to Microsoft becoming the number 1 and the most relevant technology company for decades to come. The world was increasingly becoming a cloud and mobile-first environment and for Microsoft to grown and remain relevant, they would need to adapt rather than resist. He laid down the entire roadmap of moving from a Windows-first company to a Cloud-first company. They underwent a huge engineering reorganization where he asked then Windows chief Terry Myerson (Microsoft Executive Vice President, former head of Windows) to step down. To speed up matters, he focused on inorganic growth, by acquiring Minecraft, LinkedIn, and Github in quick succession enabling the focus to shift towards the cloud.

Moving Office and Windows to a SAS model, dimming the gap between platforms by not only releasing popular products cross-platform but also allowing developers to use proprietary tools to build product across any platform, open sourcing .Net, making Visual Studio Community free, releasing products like Visual Studio Code for OSX and Linux, HoloLens, round the clock feature addition to Azure cloud services, are all great examples that indicate Microsoft’s shift towards openness and rapid development/innovation.

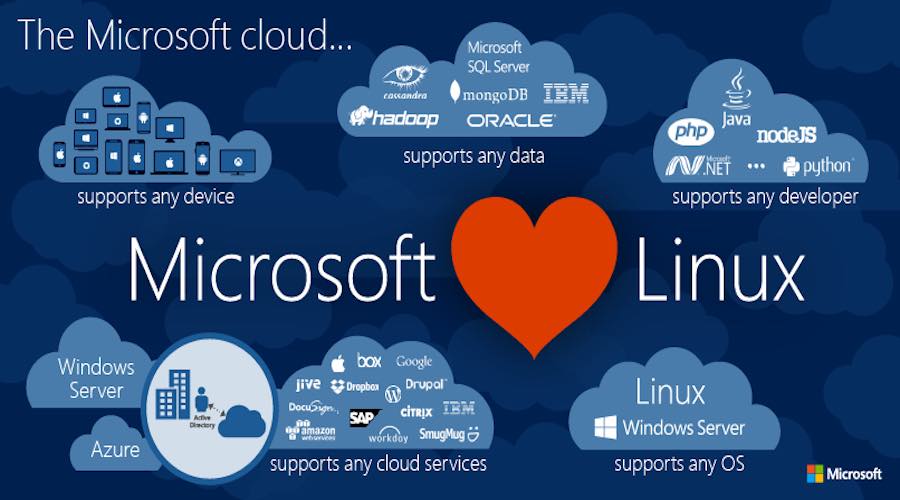

Shortly after taking over, Nadella wrote off Ballmer’s $7 billion acquisition of Nokia’s mobile phone business as a loss, eliminating more than 20,000 jobs in rather muted acknowledgment that Windows was not going to catch the iPhone and Android anytime. Microsoft was better off placing its bets elsewhere and that’s exactly what Nadella did, without remorse. Microsoft then went on to extend its collaborative approach to release more than 100 iOS apps and even embraced Linux (described later), the open-source Windows rival.

Image Source: Microsoft

With Microsoft revolutionizing its flagship MS-office suite and Windows OS through launch of Microsoft 365 Enterprise, which combines Office 365 Enterprise, Windows 10 Enterprise, and Microsoft’s Enterprise Mobility and Security features into a single subscription Office365.

Nadella is not just content with taking down barriers. He is equally keen to invest greatly in research around Mixed Reality, Artificial Intelligence and Quantum computing. Nadella reportedly believes these three to be the next key growth areas for them.

Image Credit: CSA

Cooperation and collaboration to keep customer first

Nadella seemed to be happy working on multiple fronts at the same time. From trying to shift culture at Microsoft to working with partners and collaborating across competitors, he made a point to keep customers first. Under Nadella, Microsoft went from a company trying to make customers buy Windows all the time to a company that recognized customers want solutions that Nadella laid out his new vision of cooperation through a quote which has been quoted multiple time, “It is incumbent upon us, especially those of us who are platform vendors to partner broadly to solve real pain points our customers have.”

To show his seriousness, Nadella attended Dreamforce in 2015, setting aside his personal differences with Salesforce management. In the backdrop of lawsuits both companies had filed, Nadella extended a hand of cooperation and collaboration. In the year prior, launching MS Office for iPad was Nadellas first major announcement immediately after his becoming CEO.

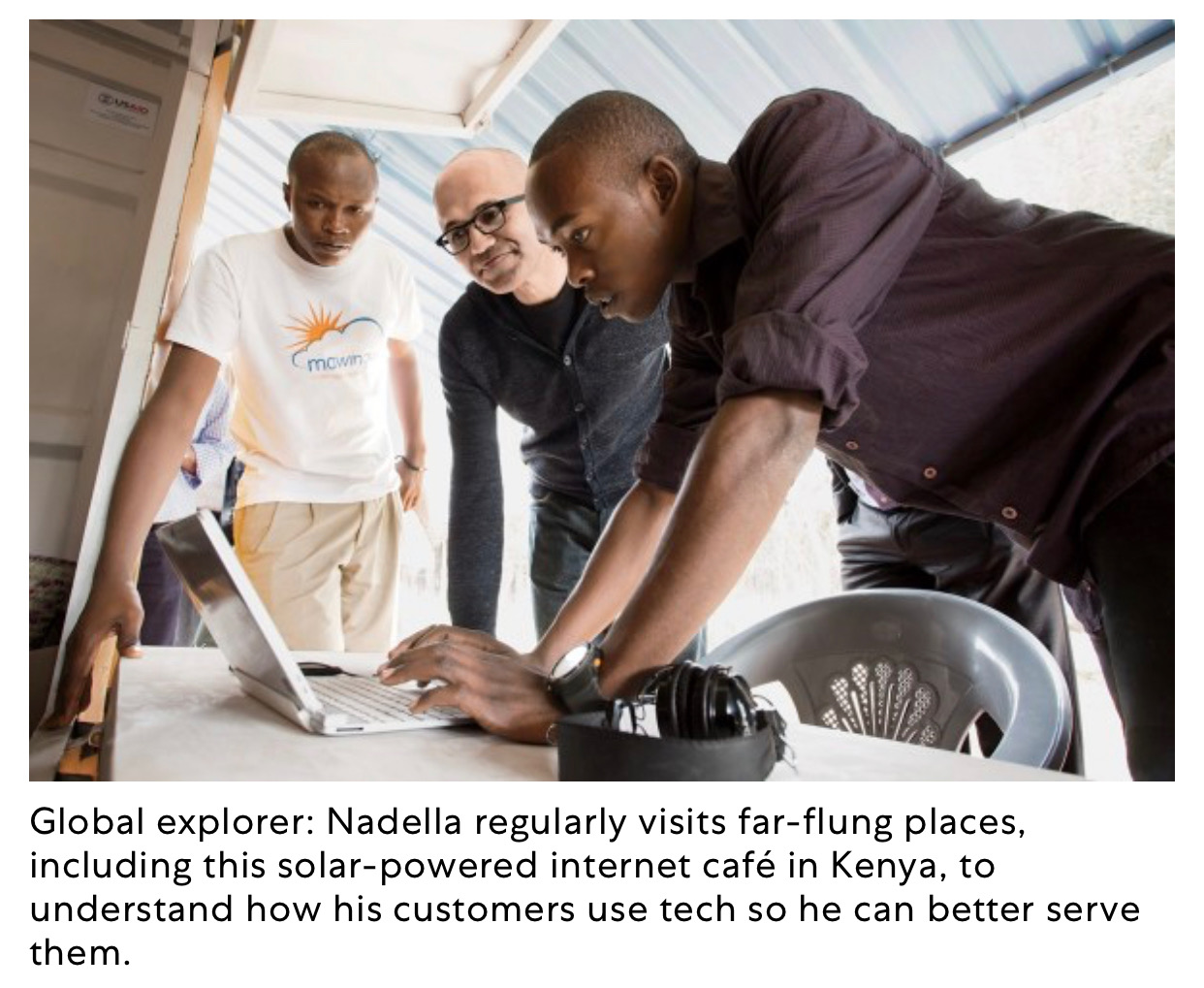

Image Source: Microsoft

Nadella’s acute business acumen and willingness to break traditional structures led to a truly path-breaking partnership with Linux. Azure was at a crossroads when Nadella took over. It was built to challenge Amazon’s market-leading AWS cloud service, launched several years earlier. Azure was also supposed to entice customers into meeting the bulk of their computing needs with other Microsoft products. If a client wanted Azure to run a Windows operating system, Microsoft was proud to take their business. Yet, if the client preferred the rival Linux approach (which Ballmer once dubbed a “cancer”), it was out of luck as Microsoft couldn’t offer a matching product. During a visit to a small start up called Okta Inc., based in San Francisco, to see how small start ups are using cloud, Nadella came up with Microsoft’s path-breaking move. Todd McKinnon, CEO and co-founder of Okta Inc., remembers telling Nadella, “We’re not using Azure, we use AWS.” Nadella shrugged. This wasn’t a sales call. It was somewhere between fact-finding and espionage. At the end of the hour-long visit Nadella had drawn out a detailed map of what startups like Okta wanted from the cloud. Over the next few months he met with at least seven other startups in similar settings. Those talks inspired Nadella to offer Linux at a special, lower price on Azure–forgoing Windows licensing fees to keep customers happy. The decision was so at odds with Microsoft’s usual lockstep methods that it later became the subject of a Harvard Business Review case study. Azure now is the fastest-growing of the five major cloud infrastructure services.

Image Credit: Microsoft

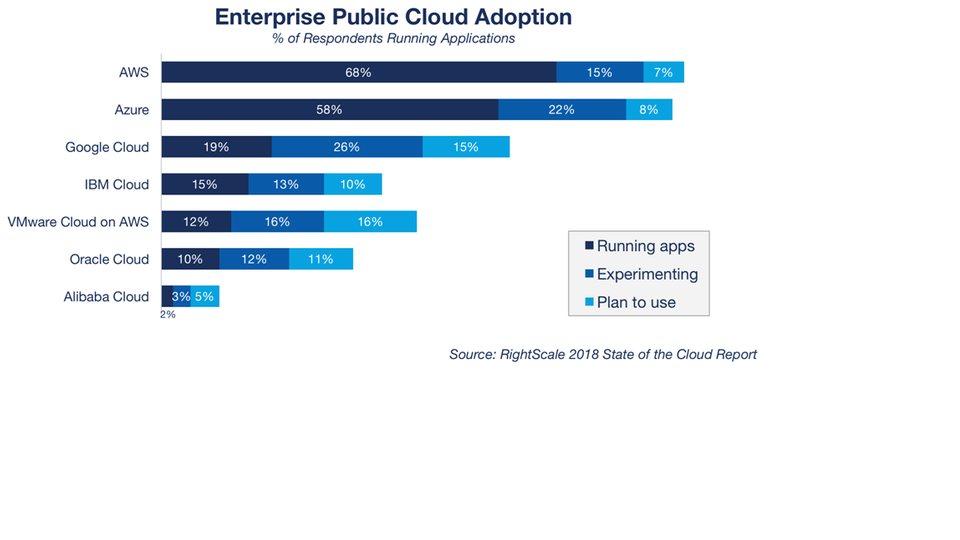

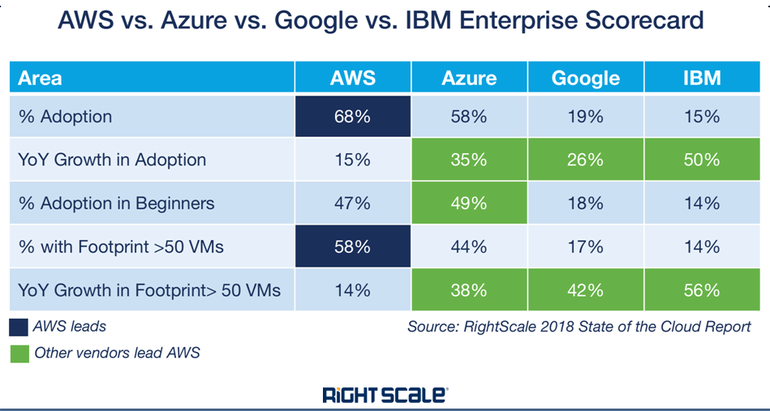

AWS started in 2006 while Microsoft launched Azure in 2010. Despite getting a significant early start and cornering substantial market share, AWS has been steadily losing ground to Azure. And for good reason. Microsoft has been very successful in signing on enterprise customers to Azure. Most large enterprises, especially those in financial services and those with any kind of sensitive data find better value proposition in Azure due to Azure’s substantial support for hybrid cloud applications. Azure helps companies protect the information that they deem particularly delicate or sensitive. Microsoft developed this hybrid approach by tapping in to its considerable background and experience with enterprise-level solutions and that has paid huge dividends.

Some of Azure’s products offer a sliding scale of hybrid cloud platform functionality, with one of their newest products providing almost all of the functionality of Azure on client’s own on-site data centers, with the payment and maintenance equal to the public cloud equivalent.

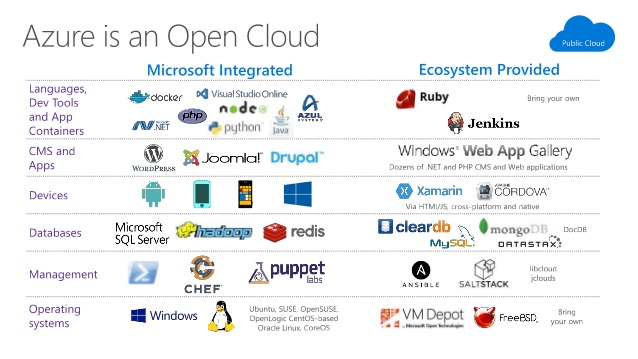

Azure supports the broadest selection of operating systems, programming languages, frameworks, tools, databases and devices. Run Linux containers with Docker integration; build apps with JavaScript, Python, .NET, PHP, Java and Node.js; build back-ends for iOS, Android and Windows devices. Azure supports the same technologies millions of developers and IT professionals already rely on and trust. Any developer or IT professional can be productive with Azure. The integrated tools, pre-built templates and managed services make it easier to build and manage enterprise, mobile, Web and Internet of Things (IoT) apps.

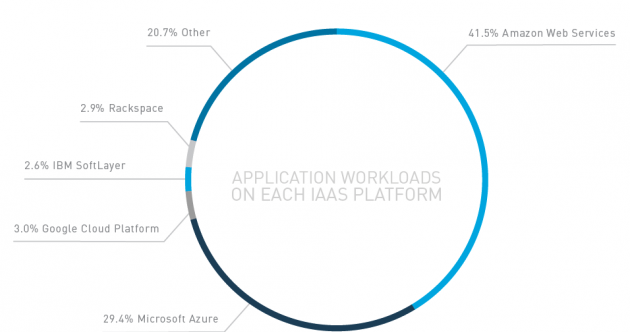

Image Credit: Right Scale

Amazon Web Services is the most popular public cloud infrastructure platform, comprising 41.5% of application workloads in the public cloud. While Amazon has long been viewed as the dominant provider of public cloud infrastructure, Microsoft Azure is gaining ground quickly in application workload. Azure currently holds 29.4% of the installed base, measured by application workloads. Google Cloud Platform trails with 3.0% of application workloads

Announced just last week, Microsoft Azure has been partnering with retail industry through its tie-ups with grocery store chain, Kroger and Walgreen Boots Alliance, the parent company of Walgreens. According to analysts, the partnership with Walgreens, which aims to develop new healthcare delivery models, technology and retail innovations to advance and improve the future of healthcare, is akin to the model Amazon has launched with Whole Foods. With Kroger, Microsoft offers retail-as-a-service, allowing Kroger to use Azure’s artificial intelligence and cloud infrastructure.

Image Source: RightScale

On the digital side, Microsoft recently announced an exclusive partnership deal with TomTom, Dutch mapping company. According to the agreement the companies reached, TomTom will become Microsoft’s leading location data provider for Microsoft Azure, putting TomTom’s maps and traffic data onto Microsoft’s cloud. Meanwhile, TomTom is picking Microsoft Azure as its preferred cloud provider.

AWS on the other hand mostly targets product makers and start ups who continue to be its main target segment. If an organization wants to build a new product on cloud, AWS is the way to go. If an organization runs an enterprise and / or has any kind of sensitive data, then Azure is your natural choice because chances are they have already made some investment in Microsoft as part of their IT strategy.

Image Credit: CSA

Make vs Buy

In his first year as CEO, Nadella hired Peggy Johnson from Qualcomm in 2014 as executive VP of business development, giving her specific mandate to strengthen Microsoft’s ties with Silicon Valley and pursue deals with companies it once solely considered rivals, such as Box and Dropbox.

In order to give the entire grand strategy push even more impetus, Nadella ordered his team to go on a buying spree. Over the last 2 years, Microsoft’s most prolific buys include scooping up LinkedIn in 2016 for $26 billion and GitHub in 2018 for $7.5 billion. Beyond the much hyped take-over of LinkedIn and GitHub, Nadella’s Microsoft has been on a quiet spree of acquiring niche firms which have added tremendous value. The below table represents how many companies has Microsoft acquired since 2014.

In 2017, Microsoft acquired Cloudyn, an innovative company that helped organizations track their cloud investments. Cloudyn gives enterprise customers tools to identify, measure and analyze consumption, enable accountability and forecast future cloud spending.

Most of Microsoft’s buys are centered around AI, Mixed Reality, Networked communities and cloud assets. “For the past five years, we’ve been incredibly consistent — buy communities, look for networked assets, look for growing markets, and look for where we’re a better owner,” Microsoft CFO Amy Hood said during a conversation with Fortune senior writer Michal Lev-Ram at the 2018 Fortune Most Powerful Women Summit in Laguna Niguel, California.

Microsoft’s most recently released quarterly statement displays stronger than before performance. Currently, Xbox Live is used by 400 million gaming devices and it has the potential to multiply its success to reach many more users across the base of 2 billion users on Nintendo Switch, Android and iOS screens. This means cross-platform play can become a big segment and that users cannot be just limited by just community features like achievements and clubs. LinkedIn now has 610 million users. And LinkedIn sessions grew 30% year-over-year driven by higher levels of engagement in the feed. And Xbox Live now has 64 million monthly active users, up from 59 million a year ago.

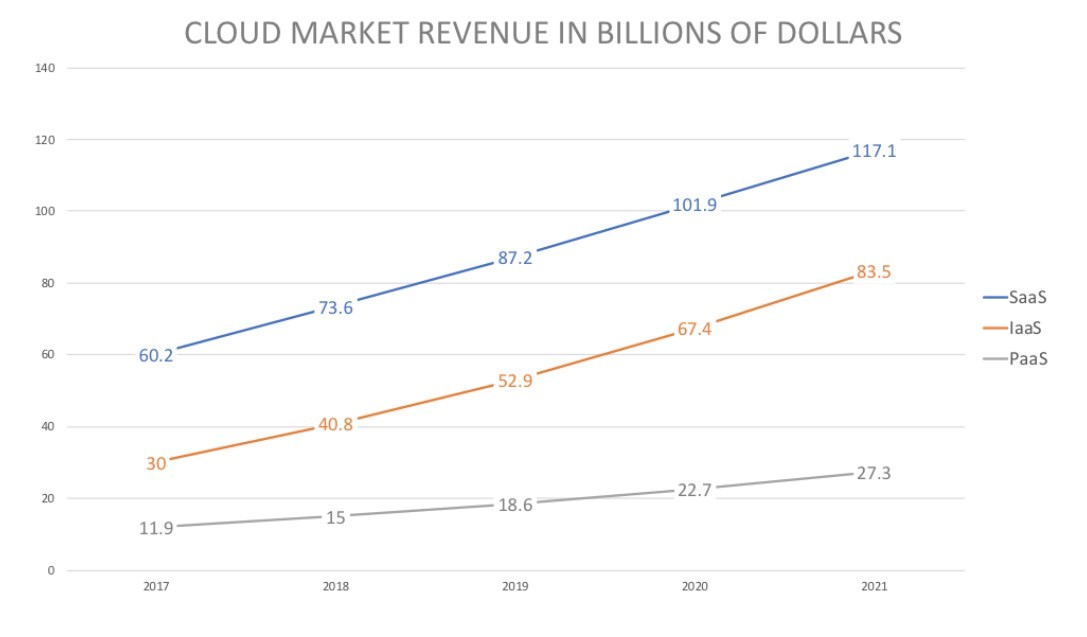

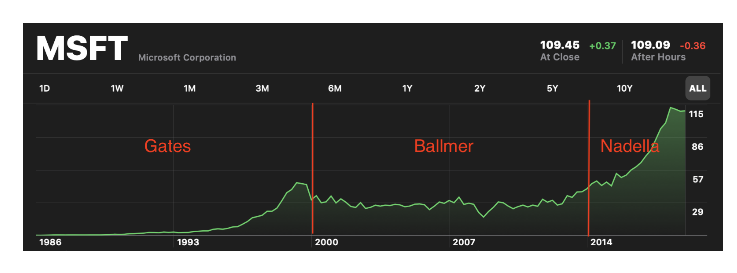

If one graph could say it all about Microsoft’s resurgence under Satya Nadella, the one below would be top contender. The Wall Street has rewarded Nadella’s vision and breathtaking finesse the only way it knows – through an increase in the share price, thereby increasing market capitalization.

Image Source: 500ish

The Push Forward!

Nadella’s unrelenting focus was to Identify channels to ensure sustainable growth. Nadella is a firm believer that the key to Microsoft’s future is presence across entire ecosystem, offering an entire assortment consisting of hardware and software combined with cloud computing.

In the words of one analyst, “Microsoft was a very monolithic and slow moving beast. However, four or five years ago, Microsoft completely changed. Now, it doesn’t look so much like one giant company as a weird conglomerate of thousands of little startups. They’re moving fast and nimble, trying things out and iterating very quickly.” Powered by this change in atmosphere, many of Microsoft’s erstwhile talent who left for greener pastures have been returning home. According to one report, more than 2,200 employees have returned to Microsoft after exiting once.

During the last season of Super Bowl, Microsoft aired a commercial with focus on accessibility. Specifically, the ad features the Xbox Adaptive Controller, designed primarily to meet the needs of gamers with limited mobility. In the ad, it shows several young kids sharing stories about using the Xbox Adaptive Controller. “When everybody plays, we all win,” says the tagline of the ad.